Banks Suck

Here’s how we chose one for our small business anyway

Banks suck. The financial industry is full of hidden and predatory fees, outdated software, and horrific customer support. From defrauding customers with millions of fake accounts to facilitating crimes against humanity across the globe, the banking industry in particular is an irredeemable blight on this planet that will find every way to extract the most money possible from you and your business, often illegally or unethically. When it came time for our small business to switch banks, being clear-eyed about the state of this industry made for a daunting but ultimately fruitful search for a place to keep our hard-won earnings. Here‘s why and how we did it.

Local Man Ruins Everything

Many years ago, when we were young and naive, we decided to open a small business bank account with Citibank since they had a close local branch and solid online reviews. This decision turned into years of pain, frustration, and fees. As our business grew, so did our frustration—but so too did the cost of switching to another institution. Other banks had similar fees and services, comparable ethical entanglements, and software that was nearly as bad. However, the issues with Citibank kept mounting.

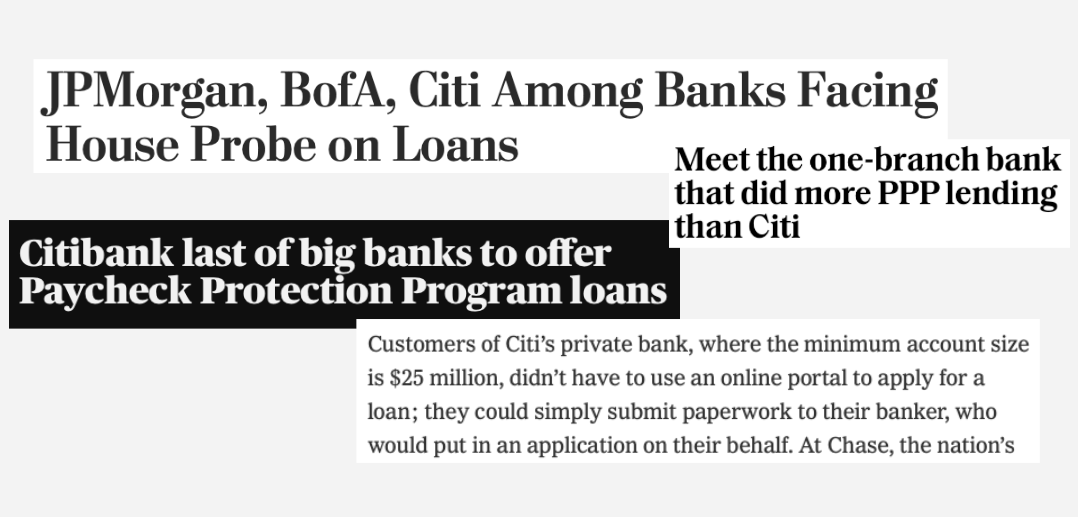

Citibank‘s website is unreliable and at times unusable for basic operations; their data doesn’t play nice with our bookkeeping software, Xero; and their customer support often creates more problems than it solves. And on top of all that, just as small businesses desperately needed their help the most during a global pandemic and recession, they decided to streamline PPP loan applications only for their largest businesses so that they could collect the most fees before they opened a single application for any other business. After this, we knew there was no way we could remain at Citibank—and so it was time to switch, no matter how much effort it would take.

Gathering Information

There are over 4,500 banks in the United States, and likely tens of thousands of different accounts to choose from. In order to compare a variety of banks and account types but also to limit the scope of the search, we compiled a list of 42 bank accounts based on several sources: lists of the top business bank accounts, recommendations from our peers, recommendations from our accountant and bookkeepers, and every Xero Banking Partner that would integrate well with our bookkeeping software. Once we had a list of accounts, we went to work gathering all the data we could possibly need for comparisons.

After the Truth in Savings Act was passed and enforcement was transferred to the Consumer Financial Protection Bureau, banks now need to disclose every fee for an account in what‘s called a schedule of fees. Using these publicly-available schedules of fees and information on the web, we devised shared categories we could use to compare each of our potential new banks, such as the type of account, monthly fees, interest, wire fees, and many more. Coming to a comprehensive total of 30 data points for each account, we needed a way to log, compare, and analyze this data, and as any self-respecting nerd knows: there‘s no better tool for this kind of structured information than a spreadsheet.

Criteria

To avoid bias toward any particular account, we decided to set the criteria for qualifying as a “finalist” before entering even a single piece of data into our spreadsheet, and used pivot tables to filter the relevant accounts in real time as they were entered. Here‘s the relatively lenient criteria that we decided was important to our business:

🤝 Xero Integration

Xero compatibility was a huge priority for us, as it could affect how much time is spent on bookkeeping and the quality of entries that we use to analyze all of our financial data.

🔐 FDIC Insurance

If anything happened to the financial institution, we wanted our funds to be insured by the federal government, up to federal limits. These accounts are safe bets that in almost all cases do not lose value.

💸 PPP

This was a really simple standard: if the bank prioritized large clients over smaller ones with PPP applications, that was not a bank we wanted to do business with. Any bank that would use funds meant to help small businesses to instead enrich themselves on large business fees is simply not a safe place to park your cash reserves as a small business.

📱 iOS App

This was the most minor of all the criteria, but since we‘re a mobile-focused company that specializes in making great iOS apps, we wanted to work with a company with at least a decent app. This can also sometimes be a proxy for software quality across the board, as lack of investment in mobile can be an indicator of sub-standard software elsewhere.

Once it was all said and done, we ended up with a massive spreadsheet with 1,260 individual entries. We then set up statistics for the entries showing the types of accounts (mostly checking), two-factor authentication (mostly SMS), insurance type (almost all FDIC), and more, with a few pie charts to illustrate the breakdown. Finally, we rounded up the finalists based on the criteria above, to some surprising results.

Finalists

Even with very simple criteria for entry, our list of bank account finalists ended up being quite exclusive: only six met the threshold to become finalists. Of those, we cut half for lack of features, nonexistent two-factor authentication, and lack of adoption. We signed up for the remaining accounts and went to work evaluating them. Here are the three that made the cut:

🏦 Azlo

Azlo was the bank we saw appear most on “best small business bank account” lists across the internet. They had almost no fees, mentioned a Xero integration, and had friendly branding.

🏦 Brex

Brex is a popular credit card company for startups, but their relatively new Cash account was also interesting to us. It also had almost no fees, the interface seemed pleasant, and their account was a “cash management account,” where a portion could be in a checking account and a portion could be invested to potentially make a greater return. We also liked that they supported accounts with custom access for bookkeepers.

🏦 Mercury

Mercury is a startup-focused bank account that came highly recommended by our accountant. They had the lowest fees of all, a beautiful interface, and were a Xero Partner. They supported customized access accounts for bookkeepers and other types of users, and when signing up you receive both a checking and savings account.

Winner

After getting a chance to use all of the above for a few weeks, the choice became clear: the bank account for us was Mercury. Azlo‘s website and app were clunky and difficult to use (they’ve since done a full redesign); Brex‘s Cash account features were a bit too limited for our use case; and Mercury was easy to use, sent much more frequent and higher quality data to Xero, had powerful debit card controls, and had the best iOS banking app I’ve ever used.

If you‘re doing a similar comparison, or just want to check our work and look at some of the statistics, we’re publicly releasing the spreadsheet that we used to compare banks. The data is accurate as of mid-2020, so may already be out of date in some cases. If you think it would be useful to you, feel free to duplicate and use it for your own comparison! Just remember this fact that we had to learn the hard way: banks suck. But at least your small business bank account doesn‘t have to.