Adding a 401(k) for Our Small Business Wasn’t Scary

…the second time we did it.

401(k)s are hopelessly complicated. At least, as a small business owner looking to add retirement benefits for our employees, that’s how it seemed earlier this year. The retirement market is flooded with indecipherable jargon, deceptive fees, and atrocious software, and the search can seem overwhelming and pointless. However, after hours upon hours of research, we broke the problem down into understandable categories that could apply to any small business, and we could not be happier with our new provider.

What Even Is a 401(k)?

Before diving into the details of our search, it’s important to have a quick refresher on what a 401(k) even is. Put simply, it’s a tax-advantaged retirement plan offered by employers in the U.S., subject to special restrictions and regulations.

Employees can make contributions pre-tax from their paycheck, paying taxes when withdrawing for retirement, or post-tax, withdrawing tax-free at retirement. The employee contributions are limited to $18,500 per year combined in 2018, and there’s a penalty for early withdrawal before retirement. There’s plenty more nuance, but starting from this baseline, it became a lot easier for us to cut through confusing terminology and rules and begin thinking about what separates a great 401(k) plan from a mediocre one.

The Sound of Settling

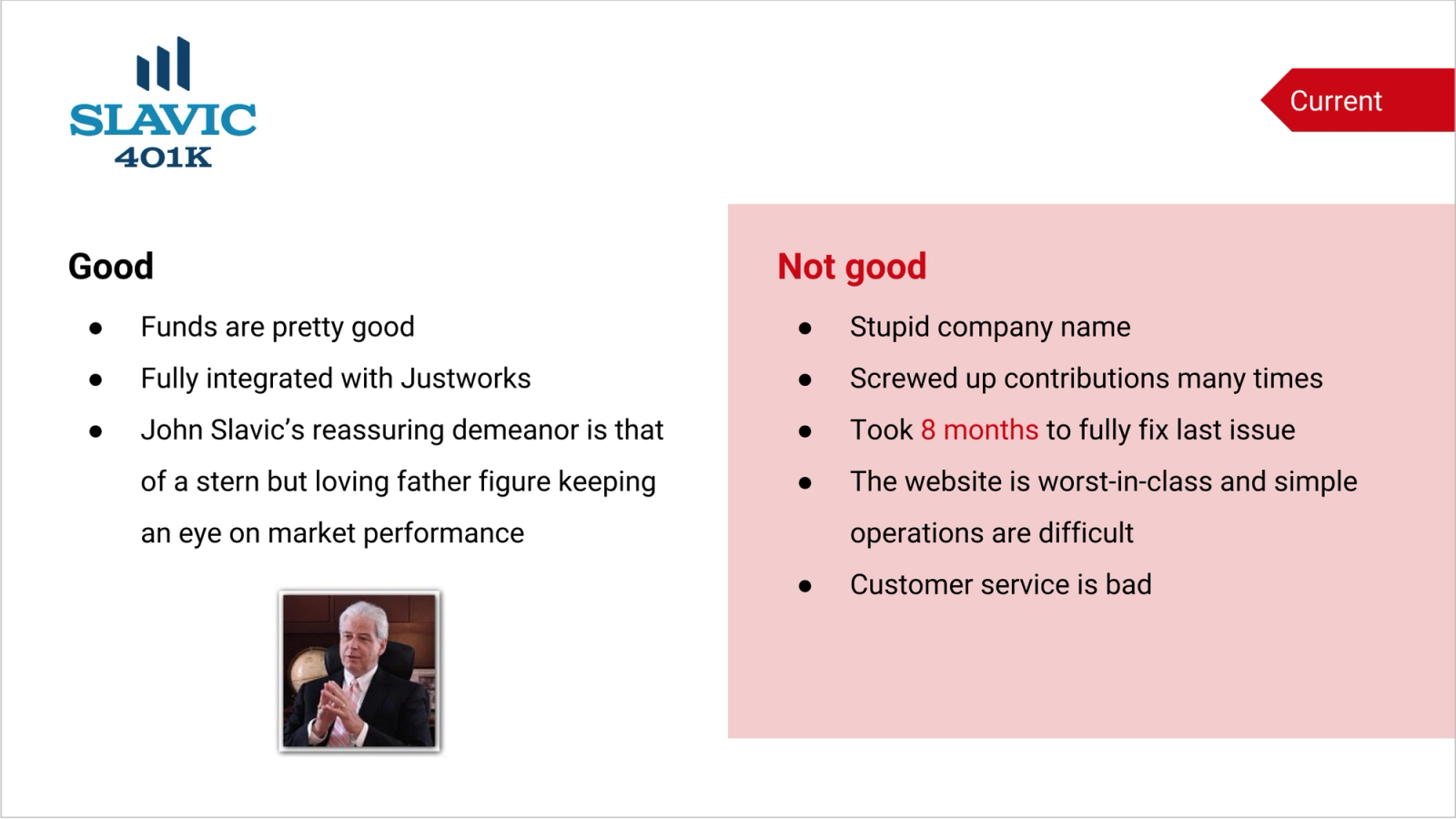

It’s a lot easier to articulate what would constitute a desirable retirement plan and provider once you realize that you’ve got a poor one. Wanting to become competitive on employee compensation with our larger competitors, and hoping to make life better for our employees in the process, we added a 401(k) plan at the beginning of 2017. Our payroll provider, Justworks (which we absolutely love), partners with a company called Slavic401k to offer plans fully integrated with payroll, so we took the path of least resistance and signed up for it, excited for our new financial future.

The warning signs came on our first paycheck contribution. I checked the numbers and immediately discovered that half the company had incorrect contributions. After Slavic corrected their error, made more, and then corrected them again, we began to suspect that this wasn’t a fluke. More than that, the website was barely usable, unable to easily show simple calculations like overall rate of return or total employee contributions. Finally, when it took 8 months to fully correct a mistake affecting one of our employees—to the tune of nearly $1000—we knew it was past time to switch.

Breaking It Down

When running a business, there is no shortage of large, daunting tasks that seem insurmountable, and breaking them down into achievable parts is a survival skill that served us particularly well when looking for a new 401(k) provider. We wanted a partner who had our employees’ best interests in mind and who made all participants feel confident that they knew how to achieve their financial retirement goals. Here’s the way we categorized those desires into measurable groups:

Fees: The average 401(k) fees for small plans are between 1.5% and 2% of assets. Our provider had total fees for participants of about 1%, which was considered relatively “low.” However, even a 1% fee can have significant effects in the long run, so we wanted to do better. There are potential expenses from providers, advisors, and the investments themselves, but any plan we chose had to have combined fees much lower than 1% for a company our size. This was the most important priority.

Interface: Saving for retirement is chiefly a psychological endeavor, a pattern of beneficial behaviors that can be reinforced and aided by software. For this reason, software quality was an important factor in our search. We wanted the interface to provide a glanceable overview of how much money is in the account, where it came from, and what returns the investments have earned. Operations like changing contribution amounts or portfolio allocations had to be simple and understandable for those without a degree in finance, in order to encourage greater participation and contributions with a lower barrier to entry.

Fiduciary: It almost goes without saying, but most financial companies are focused solely on enriching their shareholders and do not give one shit about their customers. The only way to try to ensure that one considers your interests is when they have a legal obligation to do so. A law called the ERISA defines several types of opt-in fiduciary responsibilities that require advisors to act in a client’s interest in various ways. The highest standard of care is a 3(38) investment manager fiduciary, who must act in the client’s best interest on many levels, including choosing and monitoring investments and keeping fees reasonable. We wanted to work with a company who was willing to adhere to these stricter standards and liability under the law.

Reviews: This one is pretty self-explanatory. If customers wrote a bunch of negative reviews about the company, that wasn’t a good sign.

Customer Support: I once had a Vanguard customer service employee laugh at me for asking a stupid question over the phone. This stuff can be confusing sometimes, and no one deserves that, so the bar here was “likely won’t laugh at those asking beginner questions.”

The Results

After establishing the rubric for evaluating our options, we got to work comparing the candidates listed as the “top” or “best” for small businesses according to Google searches. The results for these large to medium players in the industry were abjectly abysmal, as you’ll see below.

Yikes. Our investigation showed a complacent 401(k) industry full of inferior products. Luckily, we’d expanded the breadth of our search to include firms with hundreds of millions of dollars under management and fresher approaches, not just the trillions and billions held at the stale companies shown above.

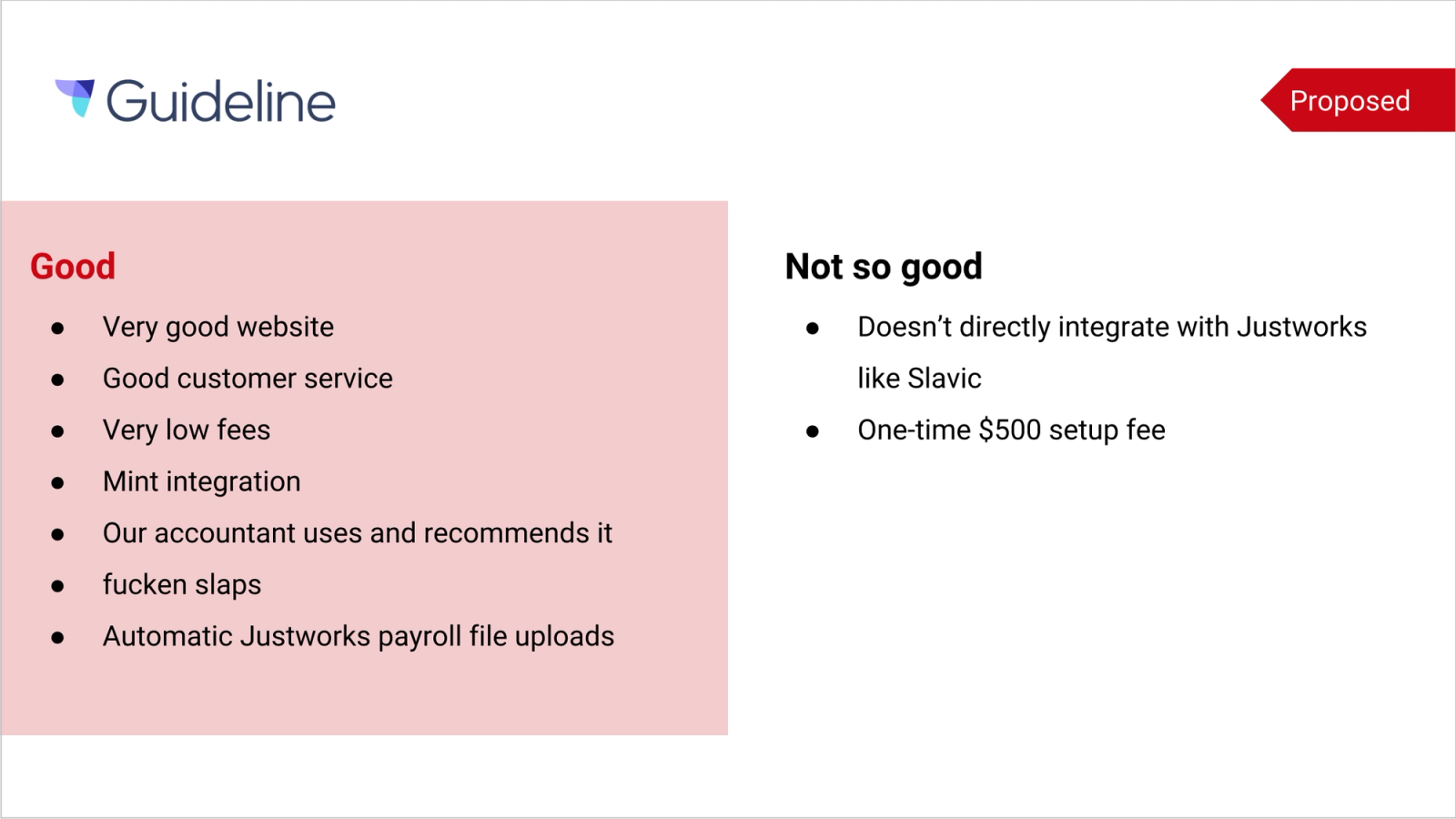

While we didn’t have great results with some of the most established companies, there were three more customer-focused ones that really stood out. Human Interest, an oddly named robo-advisor, had decent fees (about 0.58% for participants) and helpful, knowledgable employees. Betterment for Business, the 401(k) offering of personal investment robo-advisor Betterment, provided plans with reasonable, transparently low fees (about 0.35% for participants), best-in-class software, and solid reviews. And finally there was Guideline, a newer entrant that the founder of TaskRabbit started in 2015, which had absurdly low fees (about 0.06% for participants), useful and pretty software, and nearly limitless payroll integrations. Each one of these companies would take on 3(38) fiduciary responsibility with no added fees and had some great reviews, and I’m confident that any one of them would have worked well at our business — there could, however, be only one winner.

The Winner

The clear choice for us, and hopefully for many others, was Guideline. Their fees of only $8 per employee per month for the business and picks of low-cost investments with average fees of only 0.06% for participants are shockingly reasonable, putting the rest of their competitors to shame (and no, this is not a sponsored post!). They make it easy to choose a portfolio by asking participants about their risk tolerance and recommending a plan, while offering an extensive fund menu for more advanced users who would like to make their own. And, as if that weren’t enough, their software is beautiful and functional, and their representatives are helpful and professional.

Here are the Slavic and Guideline slides from my very professional presentation on switching

Although adding a 401(k) or changing your provider can seem intimidating, it’s simpler than it seems, and can make a real difference in your employees’ lives. If you run a small business, I would highly recommend spending some time to pick the right option and discuss it with your team. Hopefully, our experience switching providers can yield some useful insight into how to best evaluate your choices when you do. It may be scary, but the only thing you truly need to fear is disappointing your employees by not offering any retirement plan at all. And spiders. Spiders are terrifying.